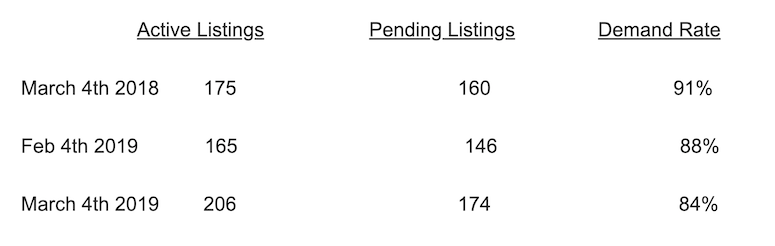

Critical Data and Rates

Active Listings: 206

Pending Listings: 174

Demand Rate: 84%

15 Year Mortgage Rate: 3.70%

30 Year Mortgage Rate: 4.43%

1. A Year Ago, A Month Ago and Now

As I covered in recent issues, keeping an eye on inventory levels and Demand Rates will be key in 2019, in identifying any shifts in fundamental market conditions and direction.

I often consider shifting my email updates to quarterly instead of monthly, but then I remember how quickly market conditions can change/shift direction and that keeping my clients and their families informed requires monthly market updates.

Both Inventory(active listings) and Pending’s(properties under contract) are up. But the Inventory is up more than the pending’s, which results in an overall lower Demand Rate.

Let’s keep an eye on this and see how the 2019 Peak Season Plays out.

2. The 4 Step Sales Process….Everyone Needs To Understand!

This 4 Step overview is a simple “Big Picture” fundamental mindset every active Buyer and Seller needs to have a sense of.

All transactions will play out with this as the Fundamental Template.

STEP 1: SALE PENDING/AGREEING TO TERMS

BUYER AND SELLER EXECUTE AN AGREEMENT OF SALE

Both parties should “know their numbers” before executing a sales agreement.

SELLERS…What are your net proceeds after selling costs and mortgage payoff?

BUYERS…What is your “cash to close” requirements and your total estimated monthly mortgage payment upon taking ownership?

STEP 2: HOME INSPECTION CONTINGENCY

Click HERE and scroll to page 6 – Section 13 of the PAR Pennsylvania Association of REALTORS) Standard Agreement of Sale, as it pertains to the contract terms of the Home Inspection Contingency.

Typically these inspections are the option and responsibility of the Buyer and are to be completed by a certain date. Usually within 10-15 days of Step 1.

The Buyer can walk away from the transaction if they are not satisfied with the property condition as stated in the written home inspection report.

STEP 3: MORTGAGE CONTINGENCY

Click HERE and scroll to page 3 – Section 8 of the PAR (Pennsylvania Association of REALTORS) Standard Agreement of Sale as it pertains to the contract terms of the Mortgage Contingency.

IN THEORY…the Buyer needs to qualify for the loan amount and the property needs to appraise at or above the contract sales price.

IN REALITY…the bank/lender can deny the loan for any reason and at any time prior to closing.

Typically the Buyer is required to apply for their mortgage within 7 days of Step 1. In most cases the lender will then need 30-60 days to process the Buyers application for a mortgage and provide a mortgage commitment or approval.

STEP 4: CLOSING/SETTLEMENT

The closing/settlement date is stated and agreed to by both parties in Step 1.

IN THEORY…This will be the closing date.

IN REALITY…Until the property closing/settlement actually occurs there are no guarantees. Under current market conditions and as an unofficial estimate, I would say approximately 50% of the transaction closings occur on the original agreed upon closing date.

Qualified, well informed and well represented Sellers and Buyers can navigate this 4 step process with minimal stress and annoyance. All others will find the real estate transaction overwhelming.

Simply forward this email to those you care about, that Need to Know this information.

3. Top 5 Questions Sellers and Buyers Need to be Asking Themselves

Sellers

1. Am I committed to selling my home?

2. How quickly can I vacate, once I receive an acceptable offer? Where am I going to go?

3. Do I understand the concept of “fair market value”?

4. Am I qualified to buy my next home, before my current home sells?

5. What are the main challenges in generating the sale of my current home?

Buyers

1. Do I have a Mortgage Pre-Approval letter

2. Am I qualified to buy a new home before my current home is sold?

3. How much cash will I need to close on my new home? And, what will my monthly payment be after I take possession?

4. Do I have a schedule or plan regarding the time-frame for this process?

5. Do I have a basic understanding and expectation of the housing market I am searching in?

Spending hundreds of thousands of dollars or selling something worth hundreds of thousands of dollars is Big Business. Please don’t wing it. Committed consumers need a committed plan.

That’s my job. Let’s talk this through!

This Month’s Prize Draw Winner

Cory Sefchick is the winner of a $100 Best Buy gift card! Congratulations Corey!

Next Month’s Prize

4 Winners will each receive a $25 Gift Card to Starbucks.

To enter the prize draw, you need to join my newsletter (bottom of the page) and then simply reply to the Monthly Value Message email that is sent.

“I could agree with you, but then we’d both be wrong.”

– Harvey Specter

Todd is honest, hard working, dependable, fiercely intelligent, and extremely knowledgeable of the residential real estate business.

I trust Todd’s professional expertise, experience and thorough knowledge of the State College real estate market when buying or selling. I wouldn’t use any other real estate agent.

You’re so good at keeping in touch, Todd.

Thanks!

RECEIVE YOUR MONTHLY VALUE MESSAGE

Our monthly value message is packed with useful information. You’ll be the first to know the latest market trends and current mortgage rates along with upcoming open houses that you can view.

I certainly will not share your information with anyone else and promise to send you only valuable and relevant information.