Critical Data and Rates

Active Listings: 235

Pending Listings: 172

Demand Rate: 73%

15 Year Mortgage Rate: 4.5%

30 Year Mortgage Rate: 5.125%

1. The Numbers

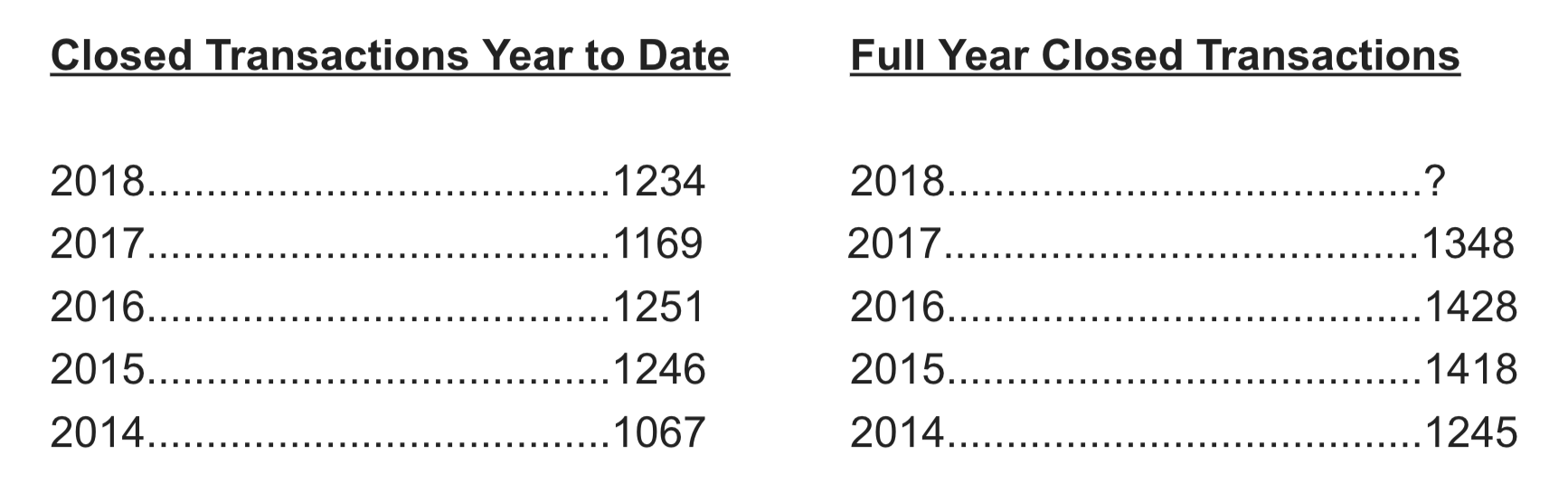

Here is a brief 5 year perspective on the size and trend of our local Residential Real Estate Market.

Below are the total number of closed residential real estate transactions, Year to Date and Corresponding Full Year, as reported by the Centre County Association of Realtors MLS.

The combined total is from properties located in the following school districts only: SCASD/BASD/BEASD/PVASD(State College, Bellefonte, Bald Eagle, PennsValley).

The total includes all Single Family, Townhome, 1/2 Duplex, Condo, Manufactured

homes.

Keep in mind there are approx 50 more days left in the calendar year.

As there are currently 172 Pending transactions as noted above, I would guess the total number of closed transactions for 2018 will be approx 1406? That would indicate an approximate increase in closed transactions of 4.5% compared to 2017.

Simply stated…what I see in these numbers is a stable market place.

We are not experiencing tremendous growth or erosion.

I will provide a more detailed end of year analysis and forecast in early January 2019.

2. Interest Rates

Interest rates for mortgages, car loans, credit cards, personal loans, business loans, student loans and just about any other kind of loan have risen over the last few months. I expect that trend to continue.

What should you be aware of and what are some ways this could effect the Local Real Estate Market?

In no order of importance, here are a few FYI’s/Mindsets

– the interest rate on my first home purchase was 9%, I knew what the total

monthly payment was, purchased the home and lived there happily for 5 years.

– if rates go down in the future, refinancing to the lower rate becomes an option

for qualified buyers.

– Homeowners sitting on a 3.75% mortgage rate, may decide they are happy to stay in their current home. This could reduce inventory levels.

– Primary and in some cases Second Home mortgage interest is still tax deductible.

Here is a link to the IRS site and info on Mortgage Interest Tax deduct-ability

https://www.irs.gov/newsroom/interest-on-home-equity-loans-often-still-deductible-under-new-law

Primary Point….if your mortgage balance is $750,000 or less for a married couple(filing jointly), all the interest on your primary residence is tax deductible.

– Interest Rate facts…Reminder for active Buyers – click HERE.

– Monthly Payment Comparison(6% rate vs 5% rate)

30 Year Fixed Rate at 5% for a $250,000 Loan

The Monthly Principal and Interest Payment = $1343.00

30 Year Fixed Rate at 6% for a $250,000 Loan

The Monthly Principal and Interest Payment = $1500.00

So the 1 % higher rate in this scenario will equate to $157/ month

Consumers (as always) need to be aware of their numbers. Keep in mind if your cable TV bill is $150/ month? you’ll need to decide on your priorities

3. Selling and/or Buying in 2019? We should be talking now!

Prepare for success in 2019.

How will rising interest rates effect the sale of my home?

How will rising interest rates effect the purchase of my new home?

What do I need to do around the house to have it ready for the market place?

When should I place my home on the market?

How do I sell and buy at the same time?

When should I contact the bank for a pre-approval on my home purchase?

What is my home worth?

How much are closing costs?

What will my monthly payment be on my new home?

Do I need to know anything about Home Inspections in advance?

I am not sure I am going to sell in 2019, but I might. Should I talk to Todd now?

How much lead time does my Realtor need to professionally market my property?

Am I assuming to much? Maybe I should start gathering some facts?

I have always believed that the sale or purchase of something valued in the 100’s of thousands of dollars should be executed with a plan.

A 10% miscalculation on a $300,000 property, could cost you $30,000

For yourself, your friends, co-workers and extended family….. you deserve to be informed and prepared.

Share this with someone you care about and if 2019 may be a real estate action year for you…contact me soon.

This Month’s Prize Draw Winner

This month’s winner of $100 State store Gift Card is Jere Northridge…Congratulations!

Next Month’s Prize

Next Month 4 winners will each receive a $25 Premiere Theater Gift Card.

To enter the prize draw, you need to join my newsletter (bottom of the page) and then simply reply to the Monthly Value Message email that is sent.

“I could agree with you, but then we’d both be wrong.”

– Harvey Specter

Todd is honest, hard working, dependable, fiercely intelligent, and extremely knowledgeable of the residential real estate business.

I trust Todd’s professional expertise, experience and thorough knowledge of the State College real estate market when buying or selling. I wouldn’t use any other real estate agent.

You’re so good at keeping in touch, Todd.

Thanks!

RECEIVE YOUR MONTHLY VALUE MESSAGE

Our monthly value message is packed with useful information. You’ll be the first to know the latest market trends and current mortgage rates along with upcoming open houses that you can view.

I certainly will not share your information with anyone else and promise to send you only valuable and relevant information.