Your current mortgage interest rate can usually be found on the monthly or quarterly mortgage statements you receive form your lender. In some cases you can call the toll free number on your statement to confirm your current rate.

Things to consider before refinancing:

- What are the total costs and fees involved in your refinance?

(Common Estimate 1.5-2.5% of loan amount) - Confirm with your lender if the interest charged on the loan is tax deductible.

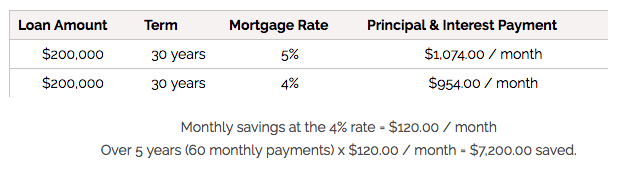

$3,600 (cost to refinance) / $120.00 per monthly savings = 30 months to cover refinance cost.

In this scenario, your refinance will be a net positive starting with the 31st monthly payment.

- Does it make sense to consider a different term (length of) mortgage… 15, 20, 30 years?

- In most cases the shorter the term (# of years) the lower the rate.

- If you qualify and have enough equity in your home, a “cash out” refinance may be an option.

In this scenario the lender may refinance a loan amount higher than your current balance, allowing you to take some “cash out” of your homes equity. This type of “cash out” refinance can carry a higher interest rate. - Occasionally some lenders will offer a “No Fee Refinance” program to their current mortgage customer’s. In these scenarios your lender will have set a criteria each client needs to meet in order to qualify for the program. If you qualify the lender will either wave their customary lender fees and you would just need to cover the non-lender related fees or in some cases the lender will cover all fees and you get a lower rate. This is always the first call to make when considering a refinance.